Stanbic Bank Uganda in legal storm over fraudulent property sale in Soroti

Justice Adonyo ruled that the bank and its agents were fully aware of and benefited from the fraudulent transaction, making them liable.

Soroti: Stanbic Bank Uganda is under heavy scrutiny following a High Court ruling that found the bank guilty of the illegal and fraudulent sale of mortgaged property belonging to Soroti-based businessman Emmanuel Abunyang.

The case, Civil Suit No. 28 of 2021, has stirred public outrage across the Teso sub-region, igniting debate on airwaves and social media platforms after Justice Dr. Henry Peter Adonyo declared the transaction unlawful and ordered the cancellation of the fraudulently acquired land title for Plot 14, Akakai Lane in Soroti City West.

Filed by Sarah Abuto and Isaac Eriaku, the suit accused Stanbic Bank, along with its agents S&L Advocates (formerly Sebalu and Lule), of disposing of their guest house without proper valuation, notice, or the legally required public auction.

The property, initially valued at UGX 200 million, was shockingly sold for only UGX 95 million to Abunyang. Court documents indicate that the sale proceeded without advertisement or consent, violating Mortgage Regulations S.I. No. 2 of 2021.

Adding to the scandal, the court heard that a valuation report was conducted after the sale, raising concerns over manipulation. The transaction was facilitated by an unlicensed bailiff, whose testimony was thrown out after he failed to appear in court.

Court records and witness testimony revealed that Stanbic Bank’s own legal officer, Mutahunga Norris, attempted to disown the contents of their official sale agreement a move that the judge rejected.

Justice Adonyo ruled that the bank and its agents were fully aware of and benefited from the fraudulent transaction, making them liable.

A twist emerged when a lawyer close to Abunyang revealed that the actual purchase price was UGX 280 million, but the bank allegedly coerced the buyer to acknowledge only UGX 95 million to cover a falsified undervaluation.

A letter from Alliance Advocates dated 25th September 2024 estimated the property’s current value at UGX 540 million, attributed partly to so-called “improvements” by Abunyang – claims now viewed with suspicion as part of a potential cover-up.

Stanbic Bank has since filed a Notice of Appeal and Misc. Application No. 147 of 2024 seeking a stay of execution. In its affidavit, the bank blamed the fraudulent land title on Abunyang’s actions, further muddying the waters of accountability.

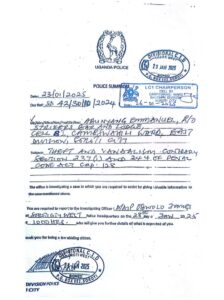

As court proceedings advanced, a new controversy erupted when Abunyang allegedly vandalized the property while facing eviction. Plaintiffs reported theft of interior fittings including doors, locks, and a water heater, alongside an outstanding UGX 500,000 water bill.

Police and local leaders confirmed that a case of theft and malicious damage had been filed, but Abunyang reportedly went into hiding. Sources claim he is a former Umeme employee whose contract was terminated under unclear circumstances.

This is not the first controversy involving Stanbic Bank in Uganda. In a previous case (Misc. Cause No. 568 of 2020), the bank was implicated in another fraudulent property sale involving its senior staff.

Although UGX 400 million in damages was awarded to the complainant, no disciplinary action against the implicated employees has been made public.

As the plaintiffs now pursue legal recourse for criminal damage and fraud, all eyes are on the outcome seen as a litmus test for justice in Uganda’s financial and judicial sectors.

Download the detail below

Do you have an advertisement or article you want to publish? Mail us at theugreports@gmail.com or WhatsApp +256757022363.